Discover your state automobile insurance policy minimal demands. Second, you require adequate automobile insurance coverage to safeguard your life from economic wreck if you have an auto mishap. That can be as simple as acquiring the minimal insurance coverage, in some situations, though rarely. Or it can be far more complex. We'll walk you through our overview on figuring this out. cheaper car insurance.

What are the kinds of vehicle insurance policy coverage? Obligation insurance coverage guarantees you against loss in instance your automobile creates injury or damage to various other person's home - low-cost auto insurance.

This insurance coverage assists pay for fixings or replacement of damaged parts. Comprehensive insurance covers problems triggered to your auto as a result of factors besides collision, such as climate, fire or burglary. Including this insurance coverage may boost the cost of your insurance costs, yet it can secure you in case something unfortunate happens to your car.

Injury security (PIP), is an insurance policy coverage that pays your clinical bills. It also covers lost earnings as well as various other costs for you or your travelers no matter that is at fault in the car crash. Medication, Pay or Clinical settlements protection resembles accident security - auto insurance. It covers your medical expenditures associated to injuries arising from an accident, no matter who was at fault.

It covers any kind of service calls if your auto breaks down and also towing expenditures, however it does not spend for car repair services. Rental automobile protection covers the expense of rental automobiles if you don't have an additional car to drive. Adding this endorsement could come in useful if your car is not drivable due to a protected case - low cost.

How Much Car Insurance Do I Need ? Get Tips From The Experts Can Be Fun For Everyone

It pays out if you create injury or home damages in an incident with one more individual. If your auto encounters problem for factors that are not connected to a mishap, mechanical breakdown insurance policy (MBI) is there to cover the prices of obtaining it taken care of - cheaper car insurance. As an example, if you have a broken engine after that MBI will certainly pay for the repair work.

That should purchase minimal degrees of liability cars and truck insurance policy? Minimum obligation is hardly ever advisable, yet if you can't manage a lot more, it's better than no insurance. If you have no savings or properties, minimal liability insurance coverage might be enough. In many states, the minimum responsibility called for by your state is inadequate to spend for serious injuries or to change a more recent vehicle.

If you possess just the clothing on your back and an older car, you may be able to get by with simply the minimal levels of responsibility mandated by your state. That's because you're possibly what is referred to as "judgment-proof." You may shed if a person determines to take you to court to spend for an accident you create, however you have no real assets to take.

The 2nd is the per-accident limit. The third number is the building damages obligation limit, which would certainly repair or change the vehicle of any person you strike. 50/100/50This level of insurance coverage is suggested for those who have an older automobile, couple of possessions, do not drive much as well as get on a limited budget-for instance, university pupils or retired people who are scaling down.

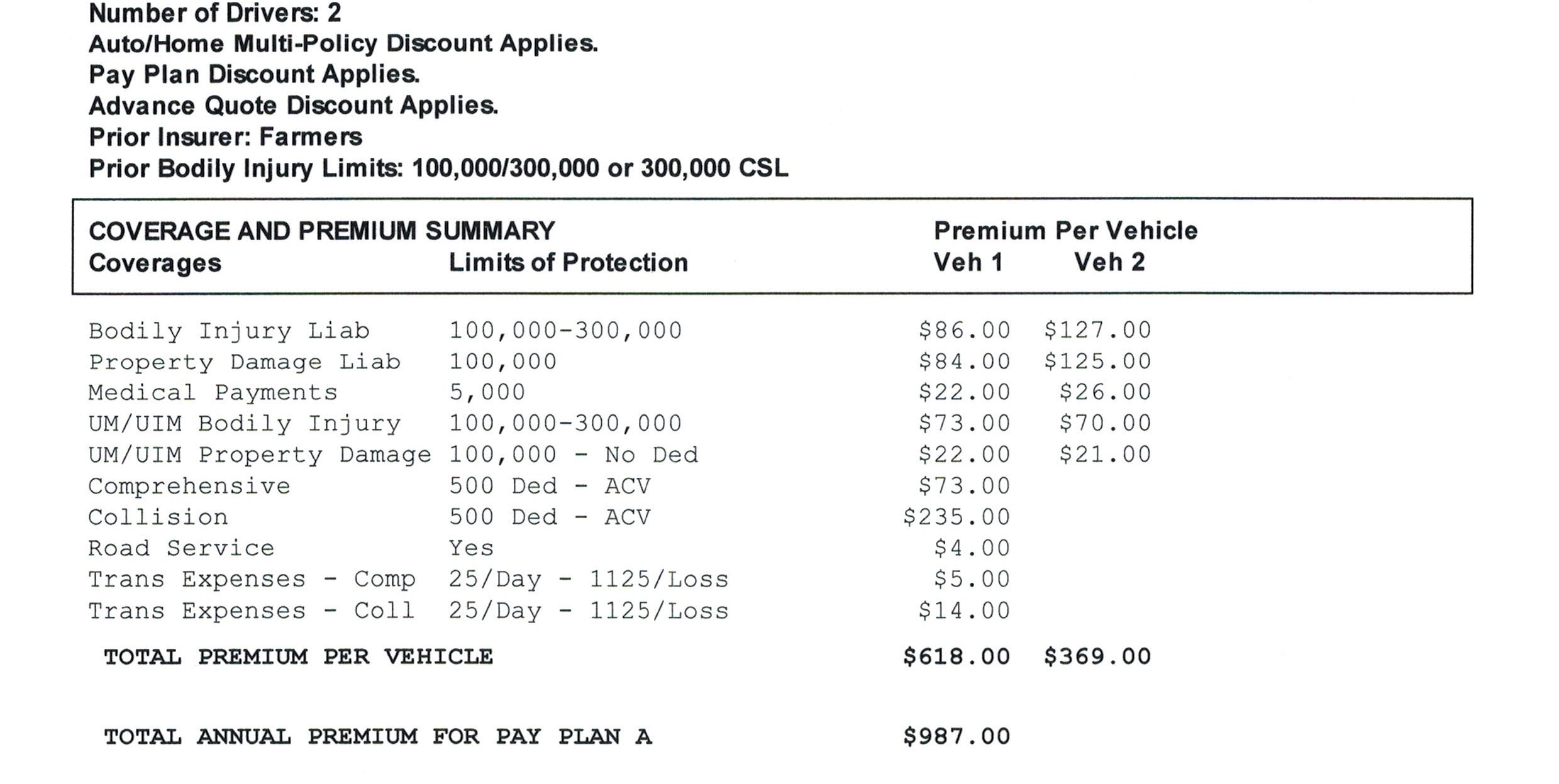

The expense of obligation insurance policy, when you have bought the standard degrees, does enhance, however does not increase exponentially. The ordinary rate for state minimum coverage is $574. The average price for 50/100/50 is $644. The average price for 100/300/100, with extensive and collision and a $500 insurance deductible is $1,758.

What Does Vehicle Insurance - Dc Dmv Do?

We would suggest supplementing even this high degree of coverage with an umbrella liability policy that extends your security by $1 million or even more. It's reasonably cheap according to the Insurance coverage Details Institute. That should buy uninsured vehicle driver cars and truck insurance? If you have your own medical insurance and also you have actually bought collision protection, you may have the ability to skip uninsured driver insurance coverages if your state enables (liability).

Your state might require only that you be provided this insurance coverage however allow you to transform it down. If you acquire this insurance coverage, it usually will come in the very same quantities as your own liability protection.

Do you need comprehensive and crash protection? Yes, if your vehicle is less than 10 years old.

Collision insurance coverage pays to fix your car if you have an accident, no matter of fault. This is where vehicle insurance coverage for a 10-year-old automobile enters into play (low cost). If your cars and truck is much less than 10 years old, you need to think about acquiring thorough and also accident insurance coverage. You ought to additionally carry detailed and also accident insurance if your automobile is 10 or even more years older, but worth greater than $3,000, or if you can't pay for to repair or replace it.

Responsibility insurance coverage pays just for others' automobiles. You should choose an insurance deductible quantity for crash as well as detailed coverages.

Get This Report on Auto Insurance

Yes, if you can't pay for or do not have the savings to live without a loss of earnings because of injury. Your state, especially if it is a no-fault state, might call for that you acquire injury defense to make sure that your injuries in a cars and truck accident are constantly covered to your restrictions, no issue whose mistake the mishap was.

Selecting the best amount of automobile insurance can be complicated. While your state possibly needs some coverage, you may locate yourself wondering if it's enough, or if you should purchase more.

If you do get crash as well as thorough insurance coverage, pay interest to the insurance deductible how much you pay of pocket prior to your insurance pays out for a claim - cars. Crash and also extensive deductibles often tend to range from $250 to $1,000; choose a quantity you could manage to pay in a jam.

Uninsured motorist coverage is suggested, Regarding 1 in 8 motorists when traveling do not have cars and truck insurance, according to 2019 data from the Insurance policy Research Study Council. business insurance. If you're hit by one of them, you might run out luck unless you have uninsured motorist protection or underinsured vehicle driver coverage in case the person whose auto hits your own doesn't have sufficient obligation insurance.

Recognizing the differences in between the type of protections that are offered can aid you pick a policy that is ideal for you. The kind of coverage you need relies on a range of variables, including the state you stay in, whether you possess or lease the auto, and also the age of the car you drive.

About California Car Insurance - Geico

This insurance coverage provides compensation for injuries to others, as well as for the damage your lorry does to one more person's residential or commercial property if you create an accident. If you are found in charge of triggering problems as an outcome of an accident, this protection may pay up to the restriction you choose, and it can give for a lawful protection if you're taken legal action against (money).

In some states, it may be provided as a mixed coverage, while in other states it may be supplied as two different protections (one for without insurance and also another for underinsured motorists). cheap insurance. Coverage can reach you and your member of the family that cope with you. As a pedestrian, if you are struck by a without insurance vehicle driver, you can be covered.

Accident insurance coverage assists pay for damages to your lorry if your cars and truck hits one more cars and truck or object, obtains struck by one more car or if your car rolls over. This coverage is typically needed if your auto is financed or rented. Comprehensive insurance coverage aids pay for damage to your car that is not triggered by an accident.

Named Non-Owner Called non-owner insurance is obligation insurance coverage for motorists that do not own a vehicle. It can additionally include various other coverages. If you regularly drive yet do not own an automobile, this protection might help protect you and your passengers. You need to consider it if you: Regularly rent cars. Drive a firm vehicle and also use it for individual usage (insured car).

Usage car-sharing solutions. Supply care for an individual you do not live with as well as drive their car. Relevant Products From fashion jewelry to antiques, you may have extra valuables than you recognize - laws. And your home insurance coverage policy may not provide the insurance coverage you require. Protect your house the means it secures you by choosing the residential property insurance protection that fulfills your requirements.

Everything about Your Guide To Automobile Insurance - State Of Michigan

Prepare & Stop Recognizing is half the fight, particularly when it concerns insurance coverage. Find out about common car mishaps and exactly how to aid avoid them. Vehicle insurance policy is an essential expense for lots of people, and also there are a variety of methods to conserve. Right here are 10 methods to save money on your vehicle insurance.

Select ... Select ... REVIEW WHAT'S COVERED WAYS TO SAVE FREQUENTLY ASKED QUESTION.

You and relative listed on the policy are additionally covered when driving another person's car with their permission (auto). It's really essential to have sufficient liability insurance policy, due to the fact that if you are included in a severe accident, you might be sued for a large amount of money. It's suggested that insurance holders buy greater than the state-required minimum responsibility insurance coverage, enough to secure assets such as your house as well as savings.

At its broadest, PIP can cover medical repayments, shed incomes and also the expense of changing solutions usually performed by someone hurt in an auto accident. It might also cover funeral costs. Home damage obligation This coverage pays for damage you (or somebody driving the vehicle with your approval) may create to somebody else's residential or commercial property.

Crash Collision coverage pays for damages to your automobile arising from a crash with another cars and truck, an item, such as a tree or telephone post, or as a result of turning over (note that accidents with deer are covered under extensive). It additionally covers damages caused by fractures. Collision protection is normally sold with a separate deductible.

8 Easy Facts About What Type Of Car Insurance Do You Need? - Moneyunder30 Shown

If you're not at mistake, your insurance company may attempt to recuperate the quantity they paid you from the various other motorist's insurance coverage business and also, if they succeed, you'll additionally be compensated for the deductible. Comprehensive This insurance coverage reimburses you for loss due to burglary or damages triggered by something other than a crash with another vehicle or things. liability.

Looking for auto insurance policy? Below's just how to locate the right plan for you and your car.. insurance.

Getty Images/i, Stockphoto If one of your 2022 resolutions is to get your funds in order, you may desire to check out what insurance policy you have, consisting of vehicle insurance policy. Some of us may not have the appropriate amount of automobile insurance coverage. Insufficient, and also a mishap can produce major economic damage; excessive, and you might just be throwing away cash.

Drivers need at least the minimum quantity of vehicle insurance coverage needed by their state and also most need even more than that, claims Les Masterson, insurance policy analyst and managing editor with A lot of states typically call for physical injury responsibility and building damages obligation coverage, about half require some type of uninsured/underinsured motorist insurance coverage, and more than a lots call for individual injury defense. cheapest car insurance.